- 20-013513.txt: 202628213.hdr.sgml: 202 accession number: -20-013513 conformed submission type: s-3 public document count: 8 filed as of date: 20200914 date as of change: 20200911 filer: company data: company conformed name: ontrak, inc. Central index key: standard industrial classification: services-misc health & allied.

- 128 11 Click Category for manual download and installation. 12 Click Network in the drop-down list. 13 Click Download to download the network driver for your computer. 14 After the download is complete, navigate to the folder where you saved the network driver file. 15 Double-click the network driver file icon and follow the instructions on the.

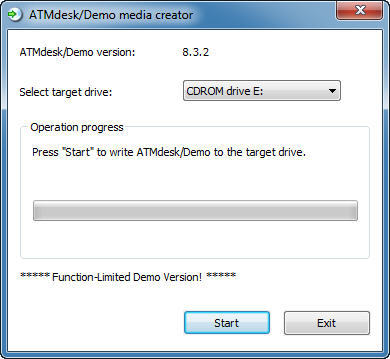

ATMdesk keys are small USB dongles where your ATMdesk licenses are stored. A key with a valid license must be present in the USB port at all times while running the ATMdesk software. To load a license to the key, you log in to your online customer account, insert the key, and follow the instructions that are displayed in the browser. ATMdesk is a third party diagnostic software for NCR 56xx, PersonaS and SelfServ ATMs. Simply boot your ATM from a floppy or CD disk and have access to all. Although all ATMs of CMB are non-NCR branded, NCR Dynamic eLock Management replace the traditional manual ATM lock and password management mode.” cash replenishment and carrying out.

ATMdesk for Field Service

ATMdesk for Field Service runs directly on the ATM’s PC core to test the installed modules in an ATM.

If you are a third-party ATM service provider or a financial institution that wants to maintain your own ATMs, use ATMdesk for Field Service to keep your ATM network up and running.

What it’s for

By using ATMdesk for Field Service, you can test NCR 53xx EasyPoint, 56xx and 58xx Personas, and 66xx SelfServ ATMs and their modules.

Download plustek mobile phones best buy. Since its first release in 2007, ATMdesk for Field Service has helped to maintain more than a hundred-thousand live NCR ATMs.

How it works

ATMdesk for Field Service is a Linux-based live CD or USB. To launch it on an ATM, you reboot the ATM from external media (CD or USB). It is not installed on the ATM’s hard disk drive (HDD), leaves no traces within the ATM, and is independent from the software that is installed on the ATM’s HDD.

The following typical scenario demonstrates how quickly you can start using ATMdesk for Field Service.

Download and install an AMD driver update. AMD drivers, much like other driver updates, can be delivered via Windows Updates. The only problem with Windows Updates is that new driver updates often arrive late. If you want to get the latest driver updates for AMD, there are a few things you can try. AMD driver update – Windows updates. The software that has been directly or indirectly provided by AMD or an entity otherwise affiliated with AMD may disable or alter: (1) software including features and functions in the operating system, drivers and applications, and other system settings; and (2) system services. Drivers amd & ati usb devices adapter. Dynabook Satellite PSC0YA-014024 AMD Graphics Driver 13.151.1.1-130826a for Windows 8.1 64-bit 1 download. Graphics Board AMD. Windows 8.1 64 bit. Feb 7th 2021, 13. For use with systems running Microsoft® Windows® 7 or 10 AND equipped with AMD Radeon™ graphics, AMD Radeon Pro graphics, or AMD processors with Radeon graphics. Download the Combined Chipset and Radeon Graphics driver installer and run it directly onto the system you want to update.

1. Reboot the ATM.

To begin, you shut down Aptra and Microsoft Windows, insert the ATMdesk CD or USB, and start the machine. The software runs and searches for all connected devices.

2. Insert the USB Key.

When prompted, you insert your ATMdesk USB key. The software validates your license and can warn you whether the license or key will expire soon.

3. Enter the Main menu.

From the Main menu, you see the various diagnostic options. Ensure that your USB key remains inserted at all times while using ATMdesk.

4. Check the device list.

When you select DEVICE DIAGNOSTICS, ATMdesk shows all devices that it found on your machine that you can test.

5. Review available tests.

When you select, for example, DISPENSER, ATMdesk offers a variety of dispenser tests.

6. Try to dispense bills.

Cash-sensitive tests are allowed only after you gain physical access to the device. Unauthorized payout is not possible.

7. Get the test results.

Upon test completion, ATMdesk displays M-Status, M-Data, and all available details in clear text.

8. Authorize USB devices.

If you replaced a USB device, you can select USB AUTHORIZATION, and then NCR Aptra accepts the new device.

9. Check the error logs.

You can check the ATM error logs for any suspicious events that suggest a potential failure in the near future.

10. Run confidence tests.

When you select CONFIDENCE TESTS, you can quickly verify the overall ATM functions before you put the ATM back in service.

11. Print or save reports.

You can print or save the ATMdesk diagnostic output, ATM logs, and tallies for documentation purposes.

12. Exit and reboot.

Atmdesk Drivers

You are now done. When you select EXIT, you can remove your ATMdesk USB key. The ATM restarts and goes back in service.

2021 is change is on the horizon: The future of the ATM

18/01/21

Atmdesk Key

Since the COVID-19 pandemic changed the world’s behaviour, ATM usage has seen a rapid decline in most geographies. This has been powered by a combination of lack of movement and economic activity (due to enforced lockdowns); an increased use of alternate channels including mobile or, even encouraged by retailers, a possibly irrational fear of the risks of handling cash, although that theory is pretty much debunked now. In 2021, the world hopes to see a gradual return to a “new normal” and as this occurs, the ATM will be a lifeline to demographics who are not comfortable with digital banking, or who are reliant on cash – writes Mark Aldred.ATMs, far from simply serving utilitarian, transactional purposes can, in fact, become relationship-building tools for banks that opt to add capabilities such as two-way video, account opening, instant card issuing, check book printing and other multifunction technologies.In the future, the potential exists for the ATM to be a Teller Machine. Rather than simply a source of cash, self-service technology can be at the heart of the redefinition of the retail banking experience provided 24-hours per day wherever there is demand.Around the world of course ATMs and devices based on the same hardware and software technologies will be deployed in volumes determined by local demand, and we will see a replacement program with a generation of cash-and-dash machines being replaced with recycling and deposit devices as well as “assisted service devices” to meet consumer demand cost effectively.Tearing out and tearing down is not the answerLegacy Banks are suffering a perfect storm; massive reductions in customers’ utilizing traditional banking channels and new entrants seizing market share with innovative digital only solutions.Tearing down branches and tearing out ATMs often from communities that aren’t ready to see them go has been the blunt instrument employed to reduce costs and increase efficiencies. But there’s a risk in terms of lost customer loyalty and reputational damage. Self-service can be at the heart of mitigating this.Globally self-service will be complemented by assisted service and remote service to offer an alternative to digital-only banking. It will be the differentiator for legacy banks and their vehicle to defend them from neobanks and fintechs trying to disrupt the market on the cheap.There is a need for greater imagination from some parts of the industry to use advances in self-service banking technology that can give a community a bank branch in a box or rejuvenate their bank branch as a focal point for financial services. The ability to customize modern ATMs to offer additional services from paying a bill to doing a live video call with a financial product specialist also allows cash access to be subsidized through generating extra revenues.The benefits of self-serviceEvery consumer has personal needs and enjoy particular benefits from their choice of channel when engaging with their bank. It could be personalized customer journeys, informative and promotional messages or contextual marketing messagesBut for those dependent on cash, self-service will be their lifeline. For communities who might otherwise lose all access to banking, self-service ATMs will prevent their rapid decline and keep their retail centers relevant. In branch, it can be a contact-free way to access all banking services, around the clock securely.Banks have for many years relied on technology to reduce their costs and increase efficiencies so that they can distribute their products and services to their customers using the most appropriate, cost effective channels. Customer-centric technologies have provided the data and tools to manage relationships in the most profitable way.However, every generation of innovation in retail banking delivery, every new technology has created physical distance between the bank and its customers. That means banks are more vulnerable than ever to competition in a world of near limitless choice.Technology, for the first time, is constraining banks. Their self-service infrastructure is typically reliant on technologies which are decades old, expensive to maintain and frustrating when it comes to innovation. That needs to be modernized so that banks can start to realize the potential of these technologies.Branch operations need to be automated using hardware and software to deliver a comprehensive banking experience around the clock and anywhere there is demand.When we speak of technology, it is easy to think about AI. That can also empower banks in delivering personalized customer experience (omnichannel marketing) and manage banking assets and cash more effectively (let’s think to predictive maintenance).Moving forward, banks will need to accommodate all of their clients’ preferences. Allowing choice to customers so that they can navigate the bank’s services their way will only be a starting point. Customer-centric does not mean forcing everyone to a mobile-only experience which may not even prove reliable, and is unlikely to differentiate a bank in a world full of choice.Behind everything they do, banks will also need to guarantee security. A topic which is so important and so public is also one that is too often treated as a side issue.Using tools which are specifically designed to provide comprehensive security and control should be a minimum requirement for banks. Recycling practices which work in a desktop environment is not good enough for banking channels; special focus must be brought to bear.Those who stick with a legacy infrastructure will find change too expensive, too high risk and too complex. They will not be able to adapt and innovate at pace and will be at risk of losing customers and business.Closing branches and not using emerging technologies to offer an alternative will disenfranchise sections of their customer base and alienate othersNot keeping up to date will lead to a race to the bottom where our financial services will be provided by a barely differentiated range of app-based entities to whom customers feel no loyalty.Why banks should consider #NextGenBranchWhat is #Nextgenbranch? It’s a full service 24-hour branch that can be anywhere. It is fully automated, yet provides a safe space for interactions both digital and personal with a bank.It can be shared and be utilized for a vast range of purposes, customized for the community it serves. Because of this, the business case will be very different from that of a legacy branch and so will its footprint.It will provide lower costs and increased revenues as well as a platform for promotion of complementary third-party products and service. It will send a message to communities and to individual customers that they are valued.The real future of the ATMWe may need to find a new name for the ATM as there seems to be so much reluctance to see it as anything other than a cash machine.Whatever we call it, self-and assisted-service technology, delivered securely and to recognized industry standards, it will complement web, mobile, telephone and other banking channels and redefine the spaces we use to engage with our banks and the hours that they are open for business.A fully automated branch, where bank staff are there to provide high value services will be built on the same technology that drives our ATMs today, but with a modernized infrastructure so as to free up its full potential. Article from: https://www.paymentscardsandmobile.com/2021-is-change-is-on-the-horizon-the-future-of-the-atm/

Atmdesk

Find out more